How can Dollar Cost Averaging (DCA) help you beat the Crypto Market Volatility?

It’s difficult! It’s difficult to predict things in the stock and crypto markets, as a small negative or positive news can have a big impact on market conditions. Over the years, Experts have developed the best practices and methodologies to taper the effect of uncertain market movements, and Dollar Cost Averaging (DCA) is one of those best techniques.

DCA lets you minimize the impact of crypto market volatility by investing in predetermined intervals and averaging the buying prices irrespective of the market changes. The cherry on the cake is that you do not need specialization in chart reading and technical analysis; anyone with minimal investing knowledge can conduct this practice. Also, DCA will reduce hours of sitting and staring at your computer screen.

In simple terms, DCA refers to breaking your investment amount into smaller parts at different prices rather than investing a lump sum of money at a single price.

How to perform Dollar Cost Averaging?

1. Determine the time frequency at which you are ready to invest. You can plan monthly, quarterly or yearly periods at your convenience.

2. Once you decide on the time period, you do not have to worry about the asset's price because it will eventually average out.

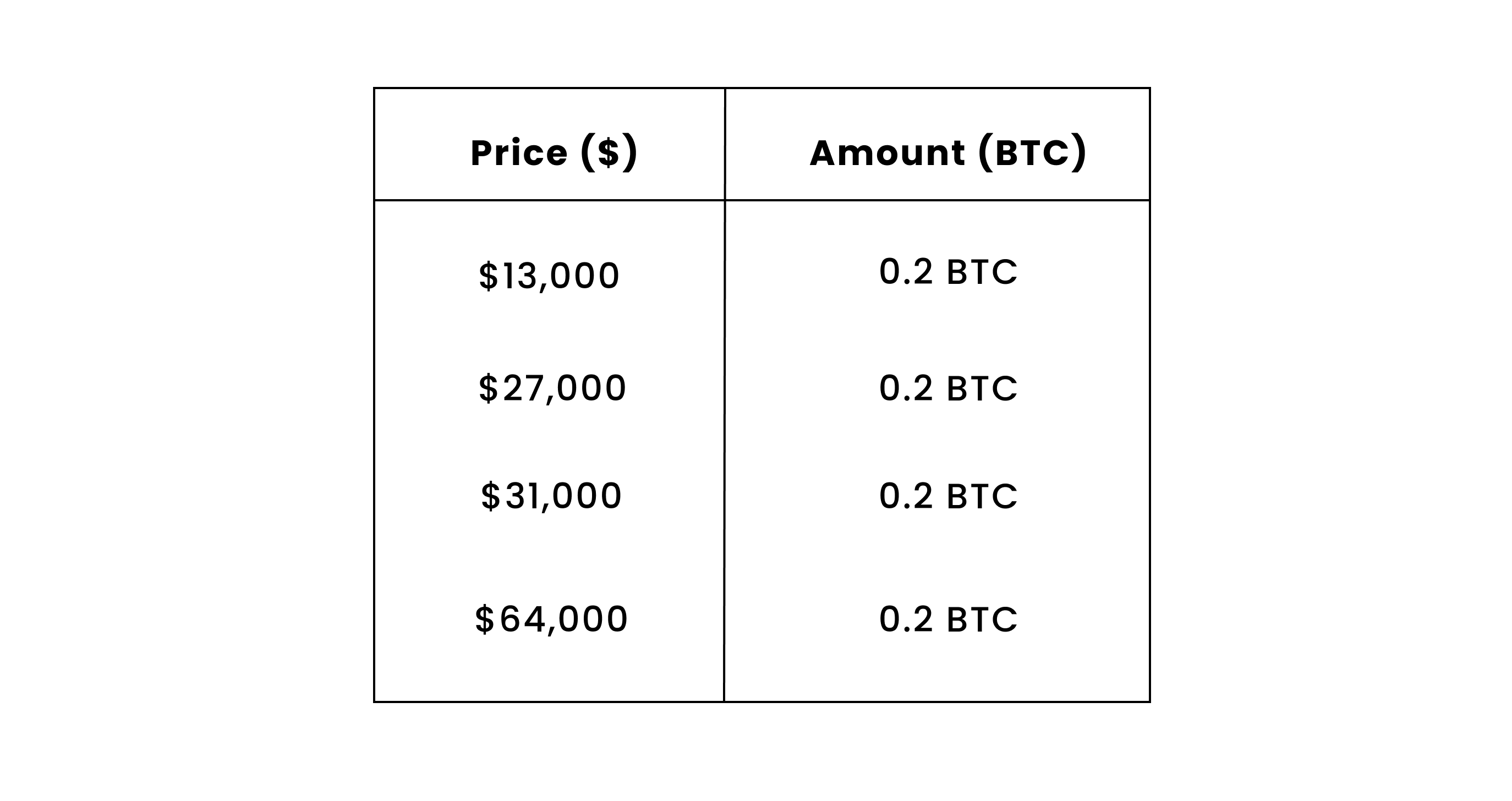

3. For instance, let’s say you want to invest in Bitcoin; you decide to invest the same amount yearly and following is your investment journey

The average price of buying 0.8 BTC with reference to the above tabular representation will be $33,750, which is way lower than $64,000.

The most important thing to consider is that Dollar Cost Averaging is effective only on long-term investments. Due to market volatility, short-term plans may risk your asset, and you might incur a heavy loss. If you are planning DCA, remove the FUD and FOMO from your emotions, as being emotional does not work out on investments.